Nailing Your Investor Deck – Top Tips From an Insider

When Brent Hoberman founded a small travel company called Lastminute at the back of a tiny office in 1998, he probably had no idea it would one day fetch more than 500 million pounds.

Most small business owners can only dream of a return like that. But if you are thinking of selling your company or raising investment, then one thing’s for sure - you need an inspiring and dynamic pitch deck to tell your story.

Richard Morecroft, entrepreneur and Managing Director at Digital Works Group, is well versed in the do’s and don’ts of pitching to investors. He says a good deck is an essential fundraising tool, whether you’re looking to raise £20,000, or £20 million.

Here are some of his golden rules:

1. Use the right slides

You might have a great idea – but a mediocre pitch deck that fails to answer key questions is unlikely to get investors to part with their cash.

A memorable pitch deck sells - so it’s important to get it right.

There’s no ‘correct’ number of slides – LinkedIn’s Series B pitch to investors in 2004 contained a lengthy 37 slides, while Tinder swiped through theirs in just 10. But in it is advisable to be concise and straight to the point.

According to Richard, they need to cover six bases:

• The introduction – Who are you and why are you here? Keep it short and sweet.

• The business – What does it do, why was it started, what gap does it fill?

• The team – The key players in your business; managers, advisors, investors etc. What are their roles and experience?

• The market – Who are your target customers? Who are the competition?

• The opportunity – What’s in it for the investor? How will the business grow?

• The conclusion – A call to action. What do you want and why do you want it?

The key, says Richard, is to make sure the pitch reflects who you’re speaking to. Make it audience specific. An investor wants a return on their money; a buyer wants to know how it fits into their existing business structure.

2. Keep it simple

As with so many things in life, first impressions are critical. You need to clearly and succinctly communicate your vision using straightforward, jargon-free language.

“If your deck looks complicated, so will your business”, says Richard. The audience must be able to grasp your message within a few short seconds.

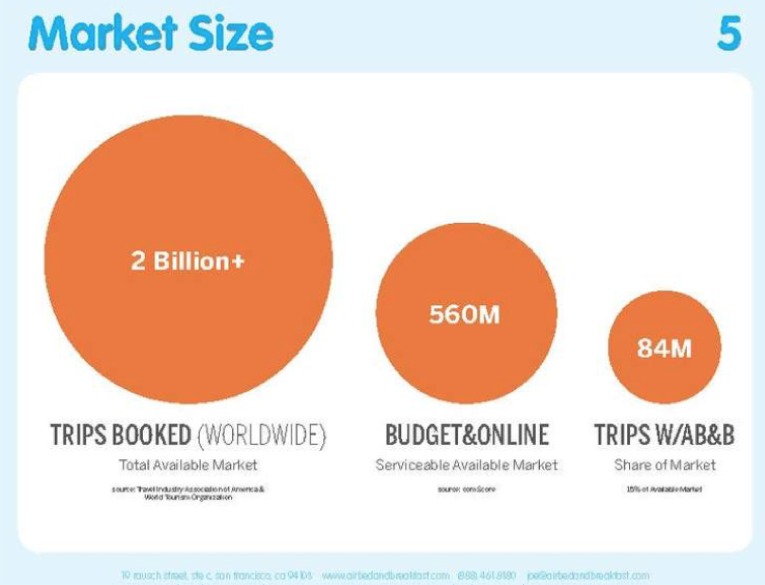

Take a look at this slide used by Airbnb in 2009 when it successfully raised $600k in its seed round:

Clear, concise, comprehensible, and obviously, attractive to investors.

A pitch deck shouldn’t be crammed with complex data. The real nitty-gritty of your business – organisational structure, financials, case studies and so on - can be put into an Information Memorandum for investors to look at later.

Your goal in the first instance is to hook their interest. Visuals, graphs, and infographics can convey your ideas quickly and effectively.

3. Know your business

Investors want to know what they’re buying, or buying into. Be prepared to answer questions, and have an understanding of the key drivers for your business, the biggest customers and the potential opportunities.

Use external advisors to get an accurate and objective picture of your company’s value and performance. You may honestly believe it’s the next Apple; but in an investor pitch, you need to be able to back that up.

According to entrepreneur Richard, many first-time pitchers give an exaggerated view of their company’s worth and then come undone when their figures are questioned.

“It’s not like Dragon’s Den,” he says. “You won’t be grilled mercilessly. But you need to be open and transparent about the facts you present, and use data and references to build credibility.”

4. Be clear about what you want

Understand what your goal is. The outcome has to be realistic and acceptable to you. All sorts of conditions could be attached to the deal, and some may not be comfortable for you.

Richard says this was the biggest lesson he learned from preparing to sell a services business.

“I hadn’t thought much beyond the sale, or how long I might be committed to the business during the transition period. I assumed I would be involved for a while, but I hadn’t specified what I wanted.”

Whether you’re selling equity or asking for a loan, be clear about the conditions of sale or investment right from the outset.

5. Work with professionals

Starting up your business, building it, nurturing it, and seeing it grow is an emotional journey. You’ve poured your heart and soul into it; now you want investors to see what you see.

Your pitch deck is your shop window. Your audience will almost certainly make up its mind about your business from the very first slide - so don’t DIY, go to the experts.

“Getting it right is crucial,” says Richard. “Clear font, good graphics, professionally presented in your own branding – it helps convince investors that you have a great product. It’s about telling a compelling story, and an impressive pitch deck can do that.”

Last updated 17th April 2024